We Analyzed 1,003,855 OnlyFans Subscribers

Here Are the 2025 OnlyFans Statistics: Economic Insights Uncovered

Last Updated: May 14, 2025

We analyzed the behavior of 1,003,855 OnlyFans subscribers from United States and 58,947,698 transactions worth $2,045,944 in revenue share.

Our goal was to understand how subscribers spend, what they engage with, and what drives revenue share for OnlyFans models.

With the help of our data analysis partner, OnlyTraffic—The #1 CPA for OnlyFans—we uncovered some eye-opening findings about the creator economy.

And today, I’m going to share what we discovered about content creation and content monetization strategy.

Here is a Summary of Our Key Findings:

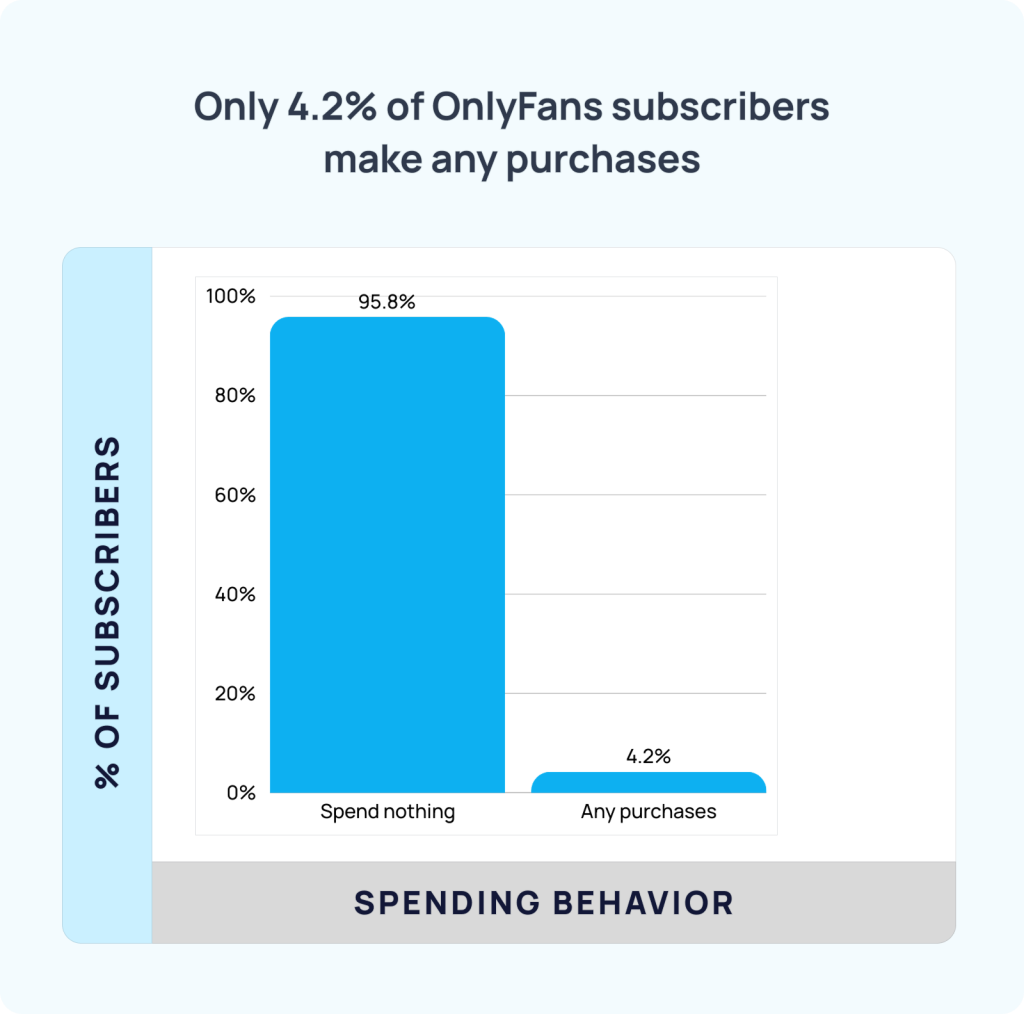

- Men from United States spend $48.52 on OnlyFans content creators, but only 4.2% of subscribers pay.

- The top 0.1% of content creators capture 76% of all revenue share, earning on average $146,881 in monthly earnings.

- Content creators earn just $2.06 per subscriber across 2,982 creator accounts. Since 95.8% of subscribers spend nothing, content creators must keep acquisition costs below $2.

- Only 0.01% of subscribers—the “whales”—generate 20.2% of revenue share.

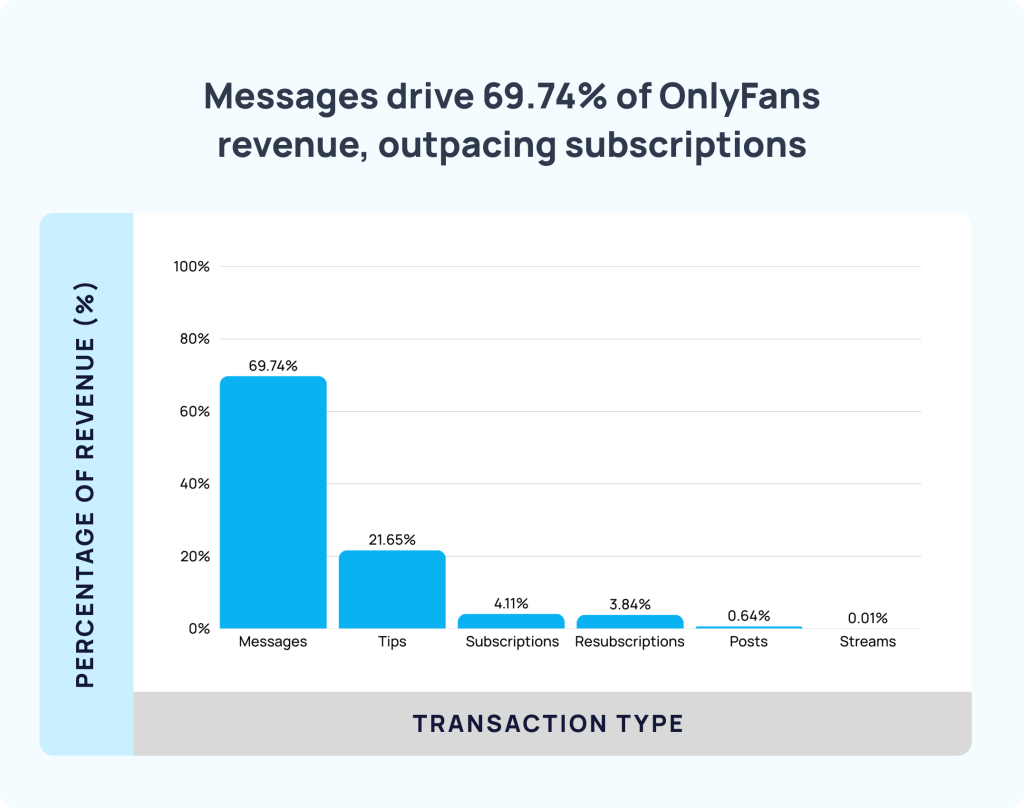

- Private messages drive 69.74% of revenue share, far outpacing subscription fee at 4.11%.

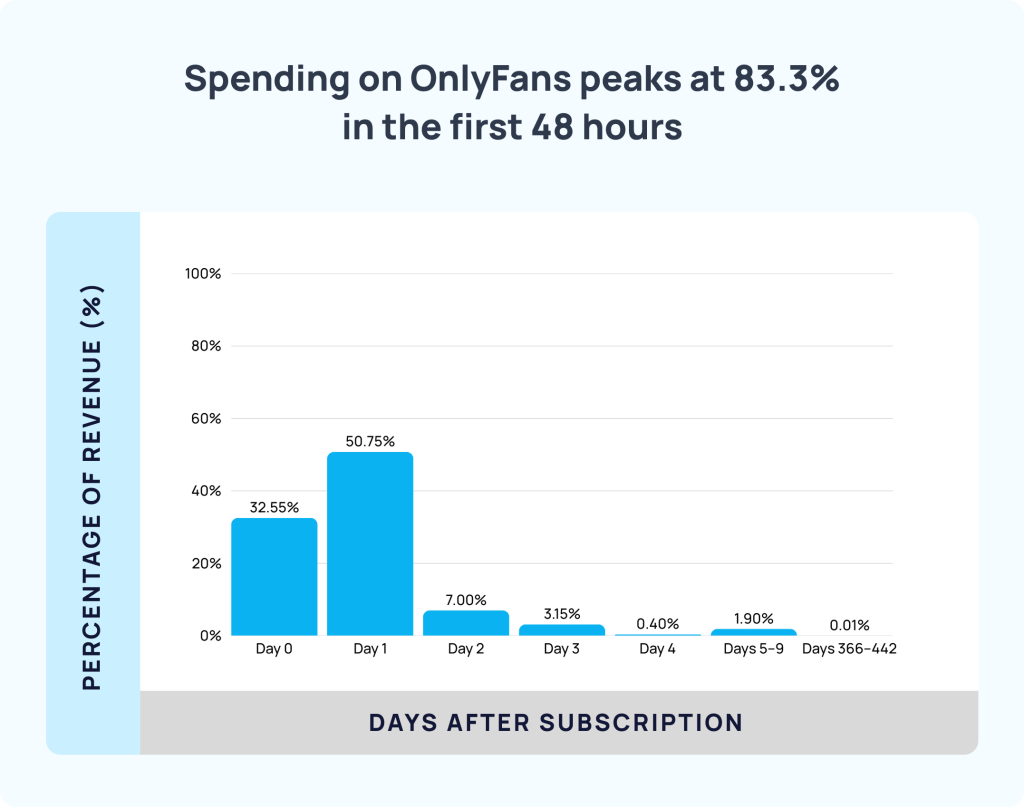

- 83.3% of payments happen within the first 48 hours, then drop sharply.

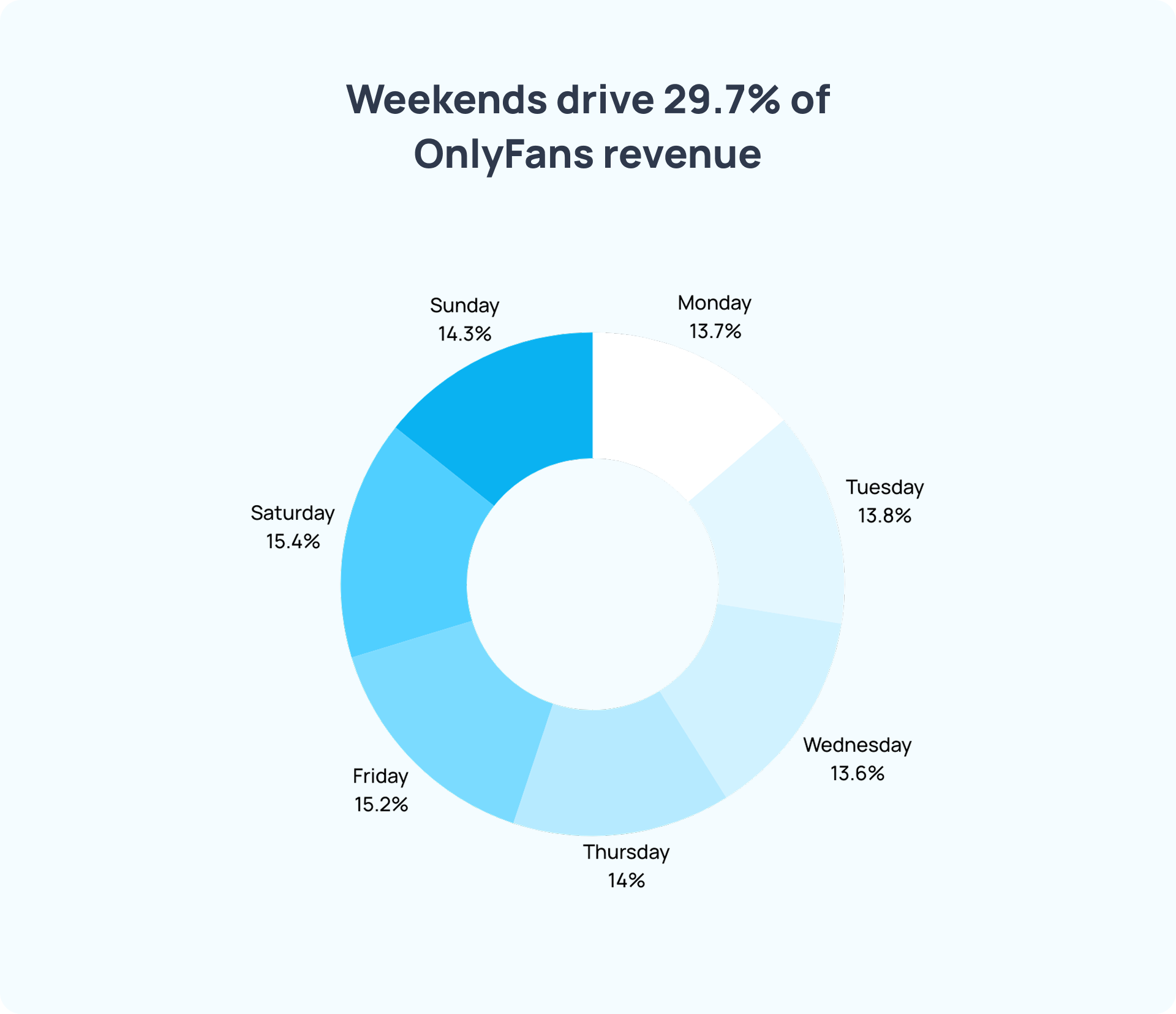

- Weekends drive 29.7% of OnlyFans’ Gross Site Volume.

- Only 17.19% of OnlyFans subscribers start a conversation.

We have detailed data analysis and insights from our findings below.

On Average, Men Spend $48.52 on OnlyFans Models, But… Only 4.2% of Them

We analyzed 1,003,855 OnlyFans subscribers to uncover their spending patterns.

To identify these patterns, we examined 58,947,698 transactions, totaling $2,045,944 in revenue.

Here’s the most interesting part:

Only 4.2% of male subscribers (42,162 users) make any purchases, while the remaining 95.8% (961,693 users) spend nothing on adult content.

Following this discovery, we decided to take a closer look at these 42,162 users to uncover more insights into their behavior.

The initial goal of our study was to determine a simple figure: the average amount one male subscriber spends.

This was straightforward to calculate.

Paying subscribers spend an average of $48.52 per creator.

Key Takeaway: Only 4.2% of male OnlyFans subscribers spend an average of $48.52 per creator, while 95.8% pay nothing.

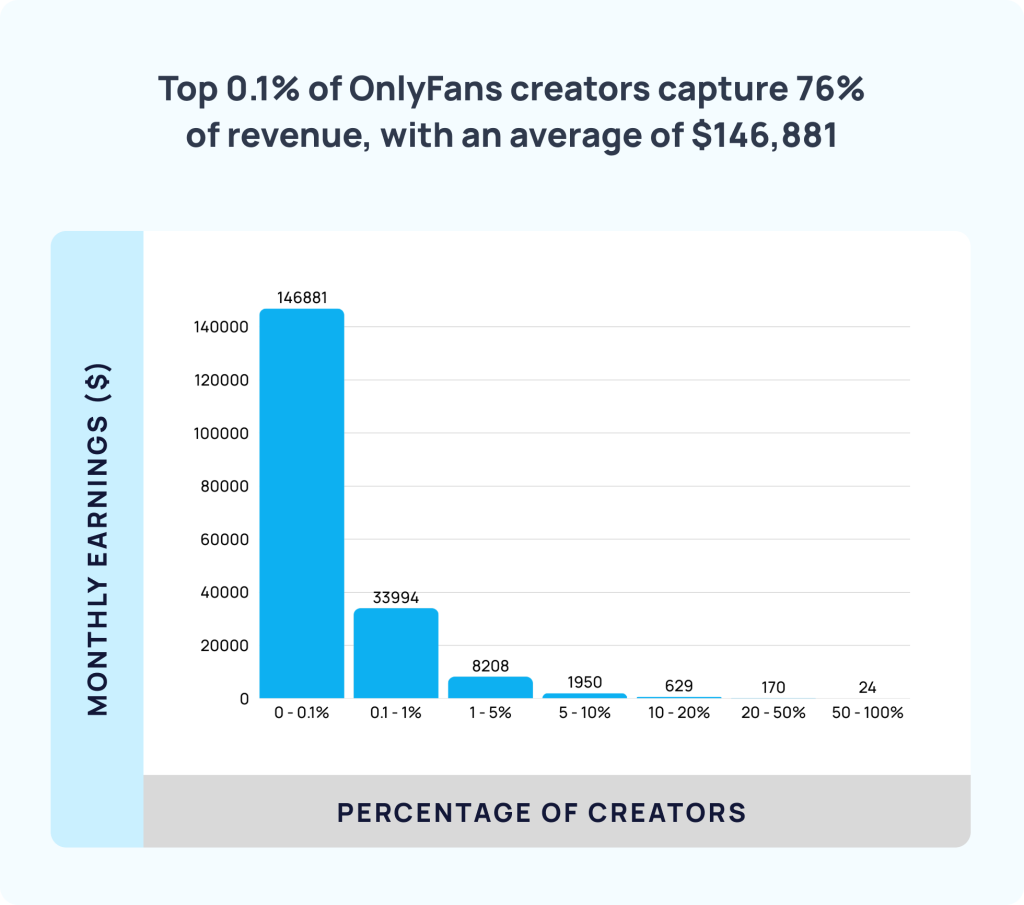

Top 0.1% of OnlyFans creators capture 76% of revenue, with an average of $146,881.

Following our analysis of subscriber spending, we explored how model ratings impact creator earnings on OnlyFans.

To conduct this analysis, we exported data for all 2,982 creator accounts from our database, including ratings, revenue, and subscriber information.

To be honest, we knew that ratings correlate with revenue, but we didn’t anticipate the extent of this correlation.

The most interesting part:

The top 0.1% of content creators, with the highest ratings, earn an average of $146,881 per month.

They capture 76% of all platform revenue share.

The next tier, from the top 0.1% to 1%, still earns a solid $33,984 on average. However, their revenue share drops to 17.72%.

From the top 1% to 5%, earnings fall to $8,208 monthly. This group claims just 4.28% of total revenue.

Beyond the top 5%, earnings plummet further. The top 5% to 10% average $1,955, while the top 50% to 100% earn only $24 monthly.

It’s no secret now that OnlyFans revenue heavily depends on the biggest content creators.

Key Takeaway: Higher-rated OnlyFans content creators earn significantly more, with the top 0.1% averaging $146,881 monthly and capturing 76% of revenue. Ratings strongly drive earnings potential.

OnlyFans Models Earn Just $2.06 Per Subscriber on Average

One of the most interesting questions is:

How much do OnlyFans adult content creators earn?

We touched on this question in the previous section. But since earnings are highly correlated with ratings and other factors, showing an exact number wouldn’t be accurate.

We found a better solution that doesn’t mislead any creator.

It’s the exact amount a creator earns per subscriber.

Here we go:

We analyzed 58,947,698 transactions across 2,982 creator accounts, so it wasn’t hard to find out.

Content creators earn an average of $2.06 per subscriber. This comes from $2,067,283 in total revenue.

Also, we previously found that 95.8% of subscribers spend nothing. This heavily skews the average downward.

Content creators must keep acquisition costs below $2. High marketing expenses could lead to losses.

Right below, we have more detailed data analysis, which will be even more shocking on this topic.

Key Takeaway: OnlyFans content creators earn just $2.06 per subscriber on average. Creators must keep acquisition costs under $2 and target high spenders to increase revenue.

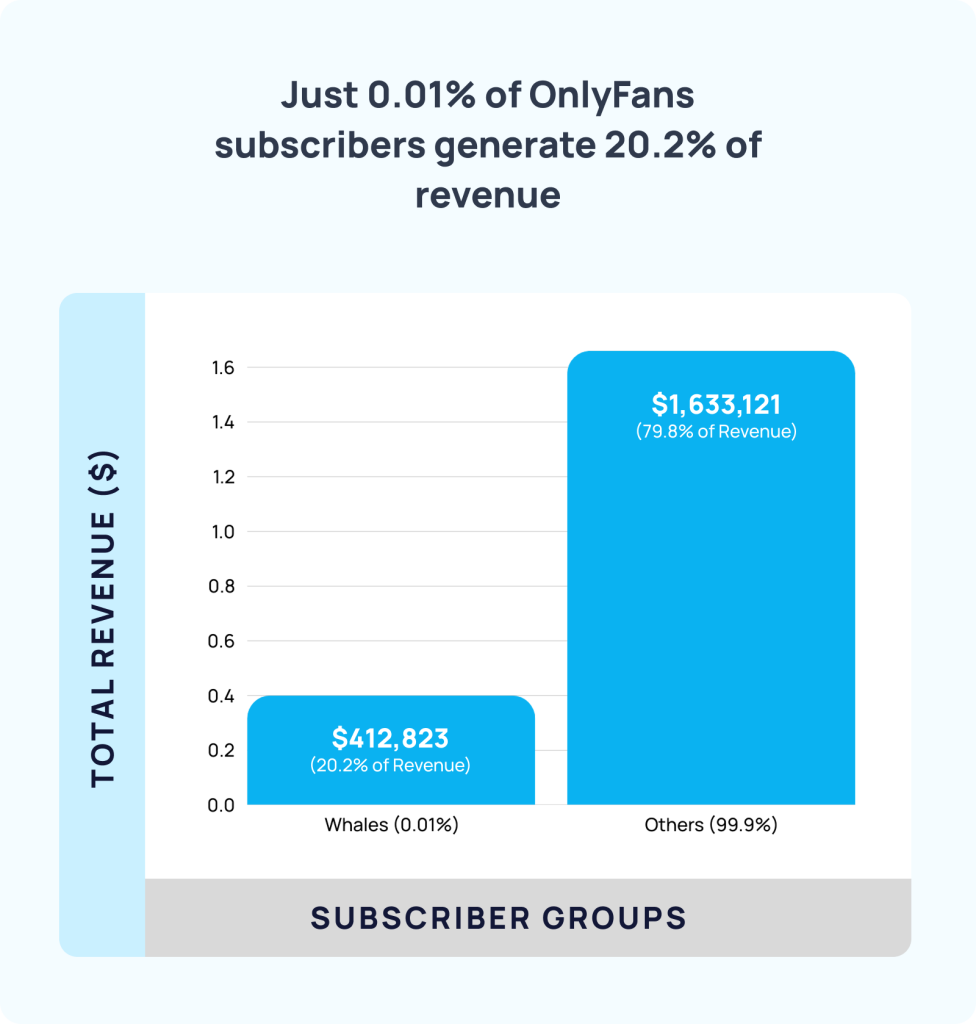

Just 0.01% of OnlyFans Subscribers Generate 20.2% of Revenue

We also analyzed content creators’ revenue from a different angle, focusing on “whales,” defined as subscribers who spend between $1,397 and $59,030.

Across the total of $2,045,944 in transactions, one particularly interesting data point emerged: $412,823 was generated by just 0.01% of all subscribers.

This accounts for 20.2% of all revenue share. The remaining 99.99% of subscribers contribute $1,633,121, making up 79.8% of the platform’s revenue.

These “whale” spenders are game-changers for content creators. Their $412,823 contribution highlights their massive impact.

Now, let’s be honest:

After uncovering this data analysis, it has never been clearer that selling skills and parasocial relationships are key for OnlyFans content creators.

Why?

Because you never know if a paying fan from that 4.2% is a whale who can drive thousands in revenue.

Key Takeaway: Just 0.01% of OnlyFans subscribers generate 20.2% of revenue share. Content creators must master engagement and selling skills to capture whales, who may be hidden among the 4.2% of paying fans.

Messages Drive 69.74% of OnlyFans Revenue, Outpacing Subscriptions

Many people think paid subscriptions are the main driver of content creator revenue.

That’s completely wrong.

After analyzing subscriber spending patterns, we examined 58,947,698 transactions on

OnlyFans to understand revenue drivers.

Here’s what we found:

Private messages dominate, accounting for 69.74% of all transactions (41,112,494). Tips follow at 21.65% (12,763,649), highlighting the critical role of direct fan engagement.

Paid subscriptions, often seen as the primary revenue source, make up only 4.11% of transactions (2,424,216). Resubscriptions add 3.84% (2,261,935), posts 0.64% (376,908), and streams just 0.01% (8,496).

This breakdown shows revenue relies heavily on private messages and tips, fueled by strong sales skills.

Key Takeaway: Private messages (69.74%) and tips (21.65%) dominate OnlyFans transactions, far surpassing paid subscriptions at 4.11%.

Spending on OnlyFans Peaks in the First 48 Hours, Then Drops Sharply

After analyzing transactions, one thing was clear.

We needed to know when they happened to find the best time for content creators to engage with fans.

Spoiler:

It’s immediate.

Across 58,947,698 payments, 83.3% of spending occurs within 48 hours.

Our earlier data analysis showed private messages drive 69.74% of revenue. Tips follow at 21.65%. This makes early engagement a top priority.

Content creators must send welcome private messages immediately. Personalized offers, like custom videos, capture early spending.

The goal is to push subscribers to spend before their interest fades.

Key Takeaway: Spending on OnlyFans peaks at 83.3% in the first 48 hours. Content creators must double down on personalization to stand out and grab subscribers’ attention.

Weekends Drive 29.7% of OnlyFans Revenue

We now know what drives the most sales and when to focus for maximum revenue.

It’s clear that in entertainment niches, weekends always get more attention for sales.

We wanted to break it down for OnlyFans, too.

Let’s take a closer look at each day of the week.

Weekends account for 29.7% of weekly Gross Site Volume. If we count Friday, it will be exactly 44.3%, which is quite significant.

Monday to Wednesday brings in just 41.7%. Wednesday is the slowest day at 13.6%.

There are no classic days off for content creators who want to maximize monthly earnings.

Key Takeaway: Weekends drive 29.7% of OnlyFans Gross Site Volume, with Saturday at 15.4%.

Only 17.19% of OnlyFans Subscribers Start a Conversation

With all this information, we wanted to clarify a key point.

What percentage of subscribers start a conversation, and how many of them could become paying customers?

We found the exact number of people who respond to our content creators’ private messages.

Here’s what we got:

Out of all subscribers, 172,563 started a conversation.

That’s only 17.19% of subscribers engaging with content creators. This initial engagement sets the stage for potential purchases.

But as we found earlier, that number falls to 42,162 for a first purchase.

This leaves a gap of 130,401 subscribers who don’t buy. That’s 12.99% of all subscribers missing the jump to paying customers.

This gap is a big opportunity for content creators to address, especially for free onlyfans models, since they attract more chances to start conversations.

Key Takeaway: Only 17.19% of OnlyFans subscribers start a conversation, but 12.99% don’t make a first purchase. Content creators must make early dialogues engaging and offer small incentives to close this gap.

Key Takeaways for OnlyFans Creators

Our data analysis shows that OnlyFans’ revenue depends on a tiny group. The top 0.1% of adult content creators earn $146,881 in monthly earnings, taking 76% of the revenue share. Content creators earn only $2.06 per subscriber on average. This clearly shows that make money on OnlyFans is not as easy as many people think — success depends on strategy, not just content.

Only 4.2% of subscribers actually pay, and 0.01% — the so-called “whales” — drive 20.2% of the revenue share. That means creators must focus on identifying and monetizing high spenders rather than chasing volume.

Private messages bring in 69.74% of creator earnings, proving that direct fan engagement is critical. Spending peaks at 83.3% within the first 48 hours, making early touchpoints essential — strong sales tactics must be applied immediately. Weekends generate 44.3% of Gross Site Volume, with Saturday alone accounting for 15.4%.

Because most fans do not return, private messages and initial chats must convert fast. Only 17.19% of users start a conversation, and that number drops to just 0.41% by the fifth purchase.

To succeed, creators must promote your OnlyFans strategically, with a clear understanding of marketing budgets and realistic sales expectations. Promotion without proper budgeting and conversion planning leads to losses. Keep acquisition costs under $2, focus on early engagement, run weekend campaigns, build loyalty through rewards, and target high-spending users to maximize revenue.

Share